Excavators are considered a standard indicator of infrastructure development and a key barometer for fixed-asset investment and economic activity. Recently, CCTV Finance, together with SANY Heavy Industry and RootCloud, released the latest data from the CCTV Finance Excavator Index, providing fresh insights into China’s infrastructure performance in 2025.

The data shows that major construction projects across China advanced steadily throughout the year. Operating rates for lifting, excavation, and port equipment remained at relatively high levels, reflecting a diversified and resilient infrastructure landscape with growth emerging across multiple regions and sectors.

Over Half of Equipment Active in 18 Provinces

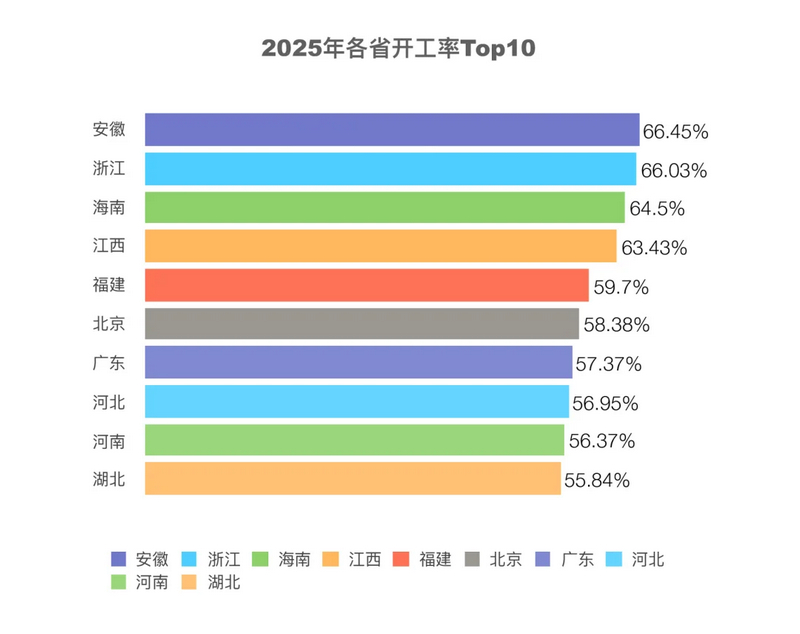

In 2025, the national operating rate for construction machinery reached 44.89%, supported by the steady rollout of major infrastructure and industrial projects. The top 10 provinces by operating rate were Anhui, Zhejiang, Hainan, Jiangxi, Fujian, Beijing, Guangdong, Hebei, Henan, and Hubei.

Notably, Anhui, Zhejiang, and Jiangxi—key provinces along the Yangtze River Economic Belt—have led the national rankings for four consecutive years.

A total of 18 provinces recorded operating rates above 50%, signaling expanding investment vitality and improving regional coordination across China’s infrastructure and industrial development.

Central China Leads Across Multiple Equipment Categories

In 2025, Central China ranked first among all regions with a comprehensive operating rate of 50.54%.

- Anhui topped the national list at 66.45%

- Jiangxi ranked fourth at 63.43%

- Henan ranked ninth at 56.37%

- Hubei ranked tenth at 55.84%

Central China accounted for four of the top ten provinces nationwide, demonstrating strong construction intensity and balanced regional growth.

By equipment category, the region ranked first nationwide in:

- Lifting equipment: 75.17%

- Excavation equipment: 58.17%

- Piling equipment: 40.66%

Among segmented equipment types, excavators and rotary drilling rigs in Central China also achieved the highest operating rates nationwide.

Guangdong Tops Total Working Hours Nationwide

In terms of total recorded operating hours, the top 10 provinces in 2025 were Guangdong, Zhejiang, Jiangsu, Xinjiang, Sichuan, Hebei, Hunan, Anhui, Yunnan, and Guangxi.

Driven by its large economic scale, dense pipeline of major projects, high equipment utilization efficiency, and preparations for the 15th National Games, Guangdong ranked first nationwide in total machinery working hours. This performance highlights the province’s strong momentum in transportation infrastructure, manufacturing upgrades, foreign trade logistics, and public facilities construction.

Heavy Lifting Equipment Takes the Lead

Among major equipment categories in 2025, lifting equipment recorded an operating rate of 71.64%, ranking first and significantly outperforming other categories.

This trend indicates that large-scale, high-value infrastructure and industrial projects—including bridges and tunnels, nuclear and wind power facilities, and large industrial plants—have become the core drivers of effective investment, with construction intensity continuing to rise.

Port Equipment Surges Alongside Foreign Trade Growth

China’s foreign trade reached a new record high in 2025, with total imports and exports amounting to RMB 45.47 trillion, up 3.8% year-on-year.

Reflecting this momentum, port equipment operating rates increased continuously from July to December, marking six consecutive months of growth. This trend underscores the sustained improvement in port operations and logistics activity.

The top 10 provinces for port equipment operating rates were Ningxia, Zhejiang, Shaanxi, Guizhou, Hebei, Tianjin, Heilongjiang, Guangxi, Beijing, and Henan, highlighting a shift from a purely coastal-driven model toward a coordinated “coastal + inland + border” development pattern.

Truck Cranes Lead Equipment Activity for 12 Consecutive Months

Among segmented equipment types, truck cranes emerged as the most active construction machinery category in 2025. Supported by broad applications in heavy infrastructure, energy projects, and large industrial facilities, truck cranes ranked first in operating rate for 12 consecutive months, reflecting the sustained intensity of major project construction.

Excavators and concrete mixer trucks formed the second tier. Excavators ranked second in seven months, while mixer trucks placed second in five months—corresponding to earthwork, concrete pouring, and other core infrastructure activities. Their stable performance confirms the steady advancement of housing construction, municipal pipelines, and industrial park development.

-

United in Vision, Connected Online | CATERBE 2026 Annual Dinner2026 / 02 / 06

-

CATERBE Celebrates Christmas with a Cozy Afternoon Tea Gathering2025 / 12 / 25

-

CATERBE Group Halloween Outing Day2025 / 10 / 31

-

CATERBE One Year Anniversary, Go Further Together2025 / 07 / 01

-

CATERBE Visited Wuyuan, Went to the Poetic Journey2025 / 06 / 05

-

CATERBE 2025 Annual Meeting: Gathering Together to Move Towards Brilliance2025 / 01 / 17

-

CATERBE Celebrates Christmas with Endless Joy2024 / 12 / 25

-

SANY Ultra-High Pressure Pump Supports Construction of 1008m Jeddah Tower2026 / 03 / 06

-

How to Properly Change Engine Oil on a Wheel Loader2026 / 01 / 06

-

Winter Maintenance Guide for Construction Equipment2025 / 12 / 10

-

Winter Maintenance Guidelines for Bulldozers Deserve Attention2025 / 11 / 27

-

Winter Forklift Battery Maintenance Essentials2025 / 11 / 21

-

Systematic Crane Maintenance Management2025 / 10 / 30

-

Troubleshooting and Maintenance Recommendations for Hydraulic System Leaks in Excavators2025 / 10 / 16